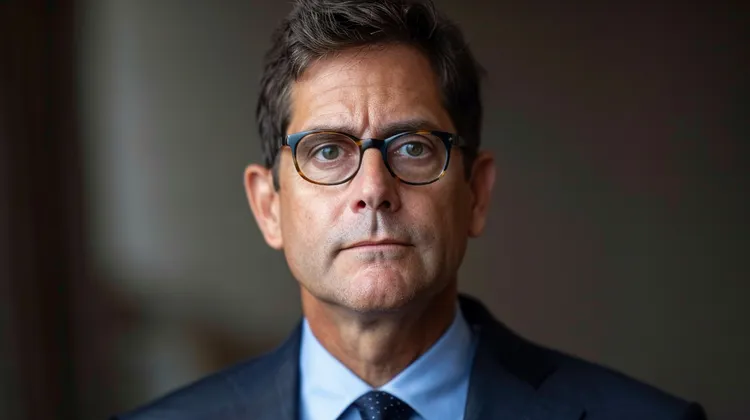

Anthony Scaramucci, the founder of SkyBridge Capital and a former White House communications director, has been vocal about his stance on Bitcoin. Recently, he has suggested that the price of Bitcoin could likely reach an all-time high before the end of the current year. This optimistic prediction comes at a time when the cryptocurrency market is witnessing a mix of uncertainty, regulatory developments, and increasing institutional interest.

Despite the volatile nature of Bitcoin, which has seen dramatic rises and falls within short periods, Scaramucci believes that several factors will contribute to its surge. One of the key drivers, according to him, is the growing adoption of Bitcoin as a legitimate investment by mainstream financial institutions. Banks and hedge funds are increasingly exploring the digital asset as a part of their portfolio strategies, acknowledging the potential of Bitcoin to act as a hedge against inflation and currency devaluation.

Scaramucci also points to the rising interest from corporate treasuries in holding Bitcoin. Companies like Tesla and MicroStrategy have already taken significant positions in Bitcoin, using it as a reserve asset. This trend signals a shift in the perception of Bitcoin, from a speculative instrument to a more stable store of value, thus potentially increasing demand and driving up prices.

He argues that the Bitcoin network’s technical advancements and the increasing hash rate, which is a measure of the network’s security and processing power, are indicators of a healthy and growing ecosystem. These technological improvements, along with the anticipated Bitcoin halving event in 2024, which historically has led to a rise in prices due to the reduced supply of new Bitcoin, could act as a catalyst for price growth.

Inflation concerns are also a significant factor that could boost Bitcoin’s appeal. As central banks around the world continue to print money to stimulate economies affected by various crises including the COVID-19 pandemic, Bitcoin’s limited supply cap at 21 million coins presents it as a potential digital gold. Scaramucci suggests that as inflation fears mount, investors could flock to Bitcoin as a safe-haven asset, much like gold has been in the past.

Regulatory clarity is another area that, according to Scaramucci, could play a pivotal role in Bitcoin’s price movement. As governments around the world grapple with how to regulate cryptocurrencies, the emergence of clear and supportive regulations could alleviate investor concerns and provide a stable environment for the crypto market to thrive.

Even though Bitcoin’s energy consumption and environmental impact have been hotly debated topics, Scaramucci has previously opined that the cryptocurrency industry’s shift toward renewable energy sources is another positive sign. Increased awareness and efforts to make Bitcoin mining more sustainable may attract environmentally conscious investors and contribute to its price performance.

Scaramucci’s confidence in Bitcoin is bolstered by the growing infrastructure that facilitates easier access to the cryptocurrency for retail and institutional investors alike. Platforms that provide futures, options, ETFs, and other financial products allow for diversified investor exposure to Bitcoin, enabling price discovery and additional liquidity.

While there’s always the possibility of geopolitical and market events influencing Bitcoin’s volatility, Scaramucci’s prediction is grounded in the fundamental belief that Bitcoin is maturing as an asset class. He frequently cites the scarcity and the network effect, where the value of a good or service increases with the number of users, as key elements supporting his bullish outlook on Bitcoin’s price trajectory.

It is important to note that like any financial prediction, Scaramucci’s expectations for an all-time high in Bitcoin’s price before the year’s end should be taken with a grain of salt. The cryptocurrency market remains unpredictable, and while positive indicators exist, external factors can lead to unexpected shifts in the market sentiment.

Anthony Scaramucci’s forecast for Bitcoin reaching an all-time high by the end of the year is driven by a combination of increased institutional adoption, technological advancements, inflation hedge potential, regulatory developments, and shifts towards sustainability in the mining sector. While the future remains uncertain, there’s no denying the growing interest and optimism shared by many in the potential of Bitcoin to reach new price milestones. As always, investors should perform their due diligence and consider their risk tolerance before making investment decisions in the dynamic and rapidly evolving cryptocurrency market.