In a major milestone for the world’s largest cryptocurrency, Bitcoin has reached a market dominance of 50% for the first time in two years. This development highlights the growing significance of Bitcoin in the digital asset market and showcases a renewed interest in its potential as an investment vehicle.

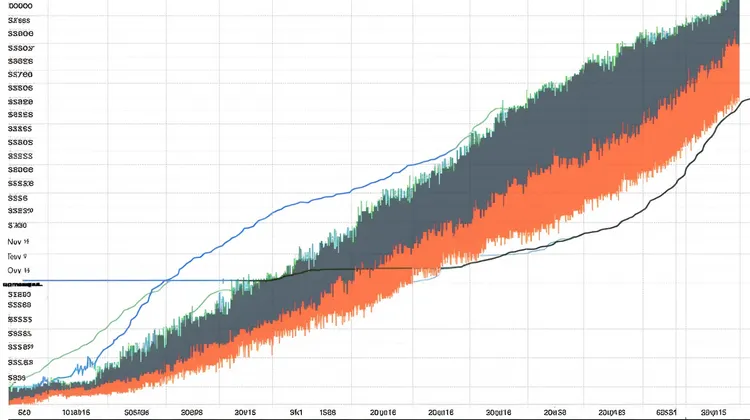

Market dominance refers to the percentage of the total market capitalization that a specific cryptocurrency holds. And while Bitcoin has always been at the forefront of the digital asset market, its dominance had dipped below 50% in recent years due to the emergence of various altcoins and the expanding crypto ecosystem.

The surge in Bitcoin’s dominance can be attributed to a combination of factors. Firstly, the ongoing global economic instability caused by the COVID-19 pandemic has led investors to seek refuge in traditional safe-haven assets, such as gold and, increasingly, Bitcoin. The limited supply and decentralized nature of Bitcoin make it an attractive choice for those looking to protect their wealth during uncertain times.

Moreover, institutional investors have shown growing interest in Bitcoin as a hedge against inflation and a diversification tool. Prominent companies, such as MicroStrategy and Square, have allocated a significant portion of their treasury reserves to Bitcoin, signaling a paradigm shift in mainstream acceptance of digital currencies as legitimate investment assets.

Another factor contributing to Bitcoin’s market dominance is its increasing adoption as a payment method. Major companies such as PayPal and Visa have integrated Bitcoin into their payment platforms, enabling users to seamlessly transact using cryptocurrencies. This mainstream adoption has boosted Bitcoin’s credibility and solidified its position as the poster child of the crypto market.

However, it’s important to note that Bitcoin’s dominance does not imply that other cryptocurrencies are losing their relevance. In fact, the overall market capitalization of the digital asset market has been steadily increasing, reflecting the surging interest in cryptocurrencies as a whole. Bitcoin’s dominance merely indicates that it continues to lead the pack and serves as a benchmark for the broader market sentiment.

The rising market dominance of Bitcoin also raises questions about the future of altcoins. Many investors and enthusiasts believed that altcoins would eventually surpass Bitcoin in terms of dominance, given their unique features and potential applications. However, Bitcoin’s resilience and enduring popularity have demonstrated that it remains at the forefront of the digital asset market and continues to be the go-to choice for investors.

Looking ahead, it will be interesting to see how Bitcoin’s market dominance evolves. As the digital asset market expands and new cryptocurrencies emerge, it is likely that Bitcoin’s dominance may fluctuate. However, given its robust infrastructure, name recognition, and widespread adoption, it is unlikely that Bitcoin will face significant challenges to its dominance in the near future.

Bitcoin reaching 50% market dominance is an important milestone for the cryptocurrency space. It signifies the growing acceptance of Bitcoin as a legitimate asset class and highlights the potential for widespread adoption of digital currencies. As the world becomes increasingly digital and decentralized, Bitcoin’s dominance serves as a testament to its lasting significance and relevance in the ever-evolving financial landscape.

Just another day and Bitcoin takes all the credit. What about other promising cryptocurrencies?

Bitcoin’s dominance is a barrier to entry for new and promising altcoins.

It’s incredible to witness Bitcoin’s market dominance reaching 50% after two years! 🎉 This milestone showcases the growing significance and influence of Bitcoin in the digital asset market. 💪

Bitcoin’s dominance is a sign of stagnation in the crypto market. We need innovation, not just one dominant player.

It’s amazing to witness Bitcoin’s market dominance reaching 50% after two years! 🌟 This shows the renewed interest and trust in Bitcoin as a safe-haven asset. 💰

Bitcoin’s 50% market dominance shows its resilience against new cryptocurrencies. It remains the go-to choice for investors and leads the pack! Keep going, Bitcoin!

Bitcoin reaching 50% market dominance is a clear testament to its robust infrastructure and name recognition. Keep on shining, Bitcoin!